Fully Automated Trading Platform

We make markets on the world’s fastest, most competitive venues. Robust, institutional grade technology is the foundation of our success.

By leveraging our technology and expertise, we provide solutions at all stages of development, including complete solutions for building, testing, and executing trading strategies. Our comprehensive suite of tools and services enable our clients to flexibly integrate their technology with ours, as their individual needs require.

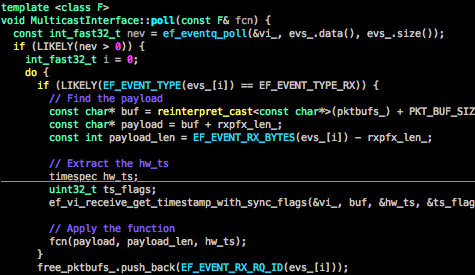

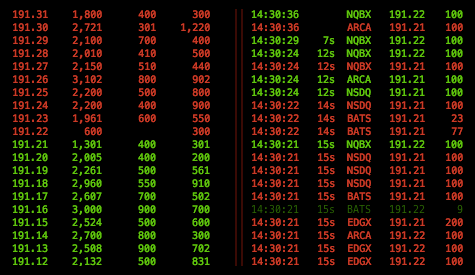

Ultra Low Latency Order Execution

Ultra low latency systems design is the very core of our business. If there is one thing we do well, it is architecting and developing the fastest software and network infrastructure possible. We wouldn’t survive if we didn’t.

We constantly work to make our execution platform faster by continuously benchmarking our software and infrastructure to identify potential bottlenecks. But order execution is more than just speed — it’s smarts, too. As market conditions change and system loads vary, so do routing and execution decisions. We know this because we live it, and we bring it to our clients.

End to End Risk Management

Risk management has several different roles and responsibilities: From satisfying regulatory and reporting requirements to minimizing damage from wayward algorithms, our risk control modules offer comprehensive, fully compliant coverage while remaining extremely fast and lightweight.

Beyond our base 15c3-5 pre-trade risk checks, we offer complete OATS reports generation and intuitive post-trade analytics.

Getting Started

Solutions for Traders & Technology Providers

Our infrastructure was developed entirely in house, enabling quick development cycles, maximum client responsiveness, and the flexibility to accommodate customized business and compliance requirements.

Trading Firms

We understand the specific needs and sensitivities of trading firms because we are traders, too. From market data to research to execution and reporting, we know where the challenges lie, and we know how to solve them.

Technology Providers

From analytics and reporting to rules and regulations, our breadth of expertise gives us unique insight on a wide range of issues applicable to broker-dealers and financial technology providers. We work with our clients to develop custom microstructure, technology, and compliance solutions.

Who We Are

About Us

We are a talented group of engineers and microstructure experts with decades of combined experience making markets across a variety of asset classes. Technology is our first passion — bleeding edge and close to the metal — but the intersection of technology, network infrastructure, and financial markets is where we thrive.

We founded Juliet in 2010 with the mission of bringing our technology-centric approach to the U.S. financial markets. We built best-in-class research and trading systems from the ground up, forged partnerships with likeminded vendors and trading groups, and used our resources and expertise to produce high frequency market making strategies that form the foundation of our business today.

In the years since, we have combined our technology, experience, and extensive network of partners into product offerings custom built for the unique needs of banks, trading firms, technology providers, and other entities in the space. By leveraging our infrastructure and software we are able to bring them to market faster, cheaper, and with the support they need to compete with existing firms.

We understand the challenges of low latency electronic trading and of the continuously evolving market landscape. We work hard to ensure our clients do, too.

Contact Us

Get in Touch

We’d love to hear from you.

Demo & Sales

To request a demo or for partnership, consultation, and project inquiries.

sales@julietlabs.comCareers

For exceptional developers and others who are passionate about capital markets.

careers@julietlabs.com